Since I left my job as a teacher about a year and half ago to stay at home with my little one I’ve been trying to get our budget under control. Since we are living off of one income for the time being (thank you amazing husband) we don’t have much wiggle room, but I do have a little more time than I was used to having to work on a monthly budget.

I talked with a friend this weekend about how hard it is to stick to a budget without driving yourself crazy and I thought I’d share what I’ve come up with. I implemented this last December and so far it has worked for us. Though I obviously use technology daily as a blogger, I’ve found that this no-tech approach to keeping a budget works best for me!

First I had to establish out monthly budget – basically how much we needed to eat, pay bills and not go into debt. I have worked a modest amount of savings into our monthly budget and when I start working again (even part time) that is the first thing I plan to spend more money on! A fat savings account, IRA and college fund would make me so happy!

After we have our savings automatically deducted and pay all of our bills, I see what we have to work with. My goal each month is to spend under $900 each monthly on groceries, gas, toiletries, diapers, clothes, toys and anything else that isn’t a bill. This is the challenging part of sticking to the budget!

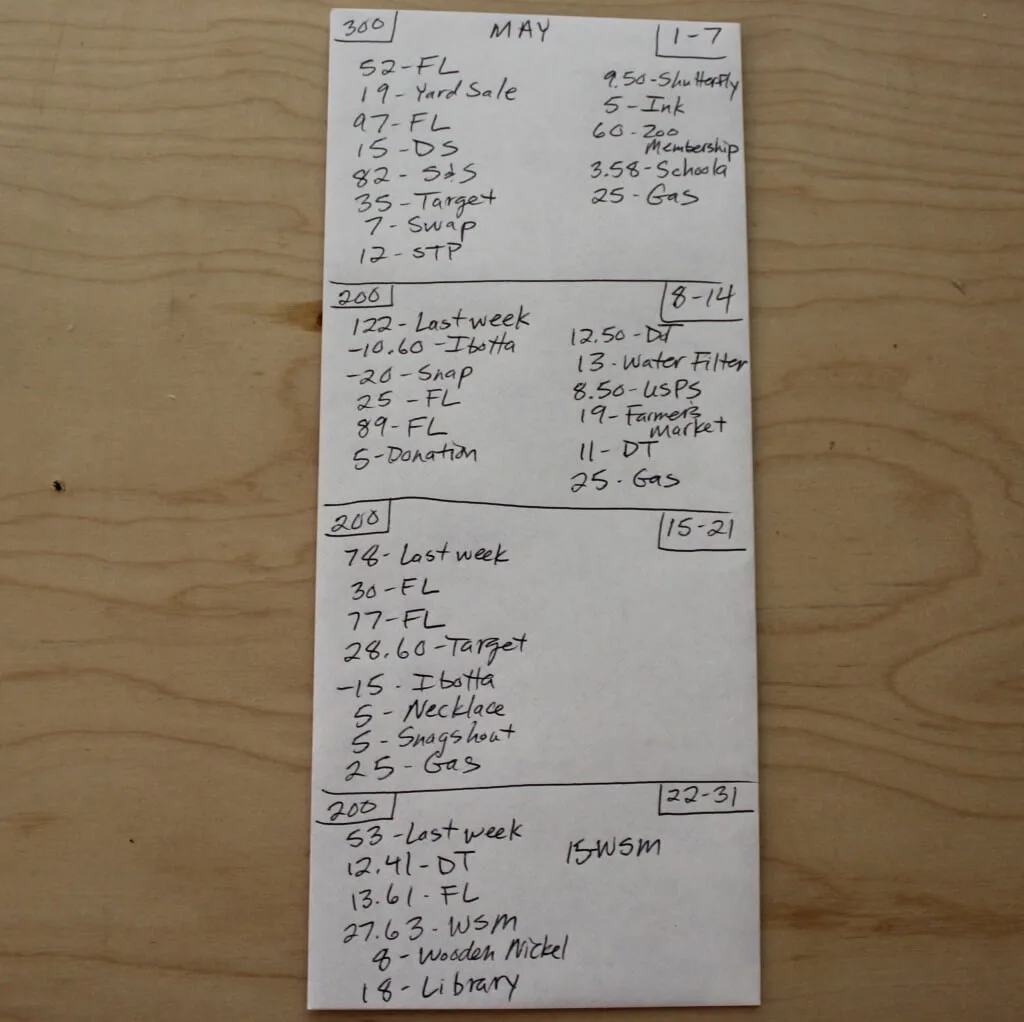

For this “everything else” category I use an envelope system, though it is not the envelope system you might have heard of before. I use just one envelope for the month which I clip to my fridge (adapted from a technique I learned over at Fun Cheap or Free). I draw lines to divide the envelope into four parts (for the four weeks of the month) in which I record any money I spent that week. Here is ours from this month:

In the top right-hand corner of each box are the days of the month for that box. In the top left-hand corner is my goal amount for that week. I allot more for the first week because that is when our Amazon Subscribe & Save shipment arrives, which includes many of our monthly necessities (toilet paper, diapers, snacks, etc.) My goal for the first week is to stay under $300, then $200 for the next three weeks.

I stick any receipts from my wallet into the envelope. I have needed receipts for rebates before and have been able to find them easily this way. I have also found it helpful to be able to go back and look at what we are buying. I also record as a credit any rebates I receive from money-savings grocery apps. This month so far I’ve earned $20 from Snap and $25.60 from Ibotta.

If I spend more than the allotted amount for the week, I bring the overage into the next week. I spent a lot at the beginning of this month with Mother’s Day and my husband’s birthday so I went over quite a bit. I have been able to make that up slowly throughout the month, though I may still be over my goal at the end of the month. At the end of the month I either move the overage into next month or find a way to make some extra money!

After doing this for 6 months I’ve noticed expenses that I would never have thought of when making a monthly budget. These are the kinds of things that likely throw many people’s budgets off. Here is a list of budget-busting culprits:

- Memberships to the zoo, science museum or water park

- Gifts for birthdays, baby showers and holidays

- Grabbing a drink or quick meal while out and about

- Library fines or other late fees (sh** happens)

- Household maintenance such as water filters and light bulbs

- Yard and garden supplies

- Toys & Books

- Postage for mailing packages (which has gotten really expensive)

- Office supplies such as printer ink and paper

- Kids’ clothes and shoes

If I have spent more than I planned on some of these items for the month, then I scale back on other spending until it equals out. This is the part that stinks. But for me, being responsible with our family’s money and making savings a priority brings more satisfaction than any new shoes, jewelry or makeup.

Please share your budget ideas below!

My Experience with the Life-Changing Magic of Tidying Up - Part 2 {Yikes! Books & Papers} - The Frugal South

Saturday 10th of September 2016

[…] six years, which means I could get rid of a bunch of files. I created a special folder and file for my envelopes full of receipts from my monthly budgeting, so they are under control now, […]

My intentional living update: What's working, what ISN'T, what's next... - The Frugal South

Friday 22nd of July 2016

[…] been coming in under budget each month and that I was overall making fewer purchases. The little envelope on which I keep track of my spending was looking less […]

When Being Frugal & Savvy Pays Off - The Frugal South

Tuesday 11th of August 2015

[…] which cards I will hold on to from year-to-year. I also stick to a tight budget each month which you can read all about here. Learning how to be savvy with credit and living frugally day-to-day is hard work. But staying in a […]