cc_advertiser_disclosure cc_editorial_disclosure

I fly from North Carolina to Orlando three to four times each year to visit Walt Disney World, and I seldom pay for airfare.

How do I pull this off? I fly for practically free using Southwest Rapid Rewards points.

From one of my MANY free flights to Orlando

Right now you can bonus_miles_full.

That’s enough to fly a family of four to Orlando roundtrip for FREE on Southwest from most cities!

Click here to go straight to the offer details or read on to learn how to earn tons of Southwest points and how to use them to visit your favorite destination more often.

How I Earn Southwest Points

Southwest’s frequent flier program is called Rapid Rewards.

The two main ways I’ve earned Rapid Rewards points are by:

- Earning a welcome bonus from a credit card

- Referring friends to this card

These are both ways that you, too, can earn points and fly to Orlando (or anywhere) for practically free, and I’ll explain them in detail below.

Chase offers several different Southwest cards, and when you open one and meet the minimum spending requirement, you’ll earn a huge number of Rapid Rewards points.

The first card I opened many years ago was the card_name, and it is still my favorite card!

I like that the annual fee is only annual_fees and I get 3,000 anniversary points each year plus two free Early Bird Check-ins when I pay the annual fee.

This card gets almost all of the same benefits as cards with a higher annual fee!

Right now you can bonus_miles_full.

All you’ll have to do is pay the annual_fees annual fee and use the card for your regular spending.

When I open a new card I use it for all of my regular spending for the first few months to reach the minimum spend. I easily spend $1,000 per month on groceries, gas, insurance, and utilities.

Click here to learn how to apply.

Please note:

- You will NOT be approved for this card if you have opened more than four new credit cards (with any bank) in the last 24 months, regardless of your credit score. This is called Chase’s “5/24 rule” and it applies to almost all of their cards now.

- You can only earn the bonus points if you do not have a current Southwest Rapid Rewards Credit Card and have not received a new Cardmember bonus within the last 24 months.

- I only recommend opening a new credit card if you have a history of using credit responsibly and paying your bills on time.

What Are Southwest Points Worth In Money?

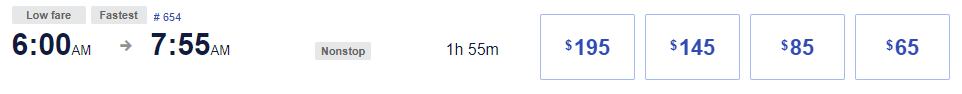

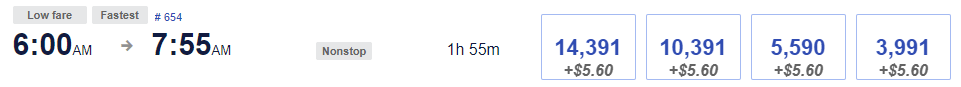

Above is a comparison of points versus cash for the same (very cheap) flight to Orlando (MCO) from my home airport, RDU.

As you can see, the $65 flight will use 3,991 points. This comes out to 6,140 points being worth $100 in flights.

So the intro bonus points for this offer will be worth over $1,000 in free flights.

As you can see, this bonus is worth FAR more than a standard credit card welcome bonus of $200-$500.

How Far Will My Southwest Points Go?

The reason I am able to visit Walt Disney World several times each year and still have points to spare is that I use them wisely!

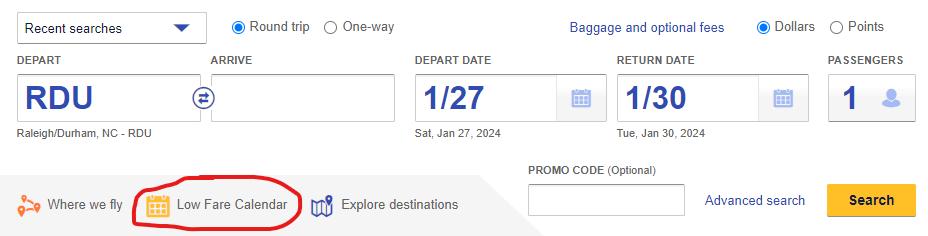

My secret is to use the “Low Fare Calendar” search option on Southwest’s site which you can find on the homepage – it is circled in red in the image above.

Searching by the month will show you the best dates to travel to get the most out of your points!

When you redeem your points for a flight, you will still have to pay a $5.60 security fee each way. So a round-trip flight to Orlando to visit Disney World costs me $11.20 per person.

Click here to learn more about the Southwest Plus Visa.

Does The Southwest Card Have An Annual Fee?

There is a annual_fees annual fee for this card that is not waived the first year.

However, you will receive 3,000 anniversary points every year on your cardmember anniversary.

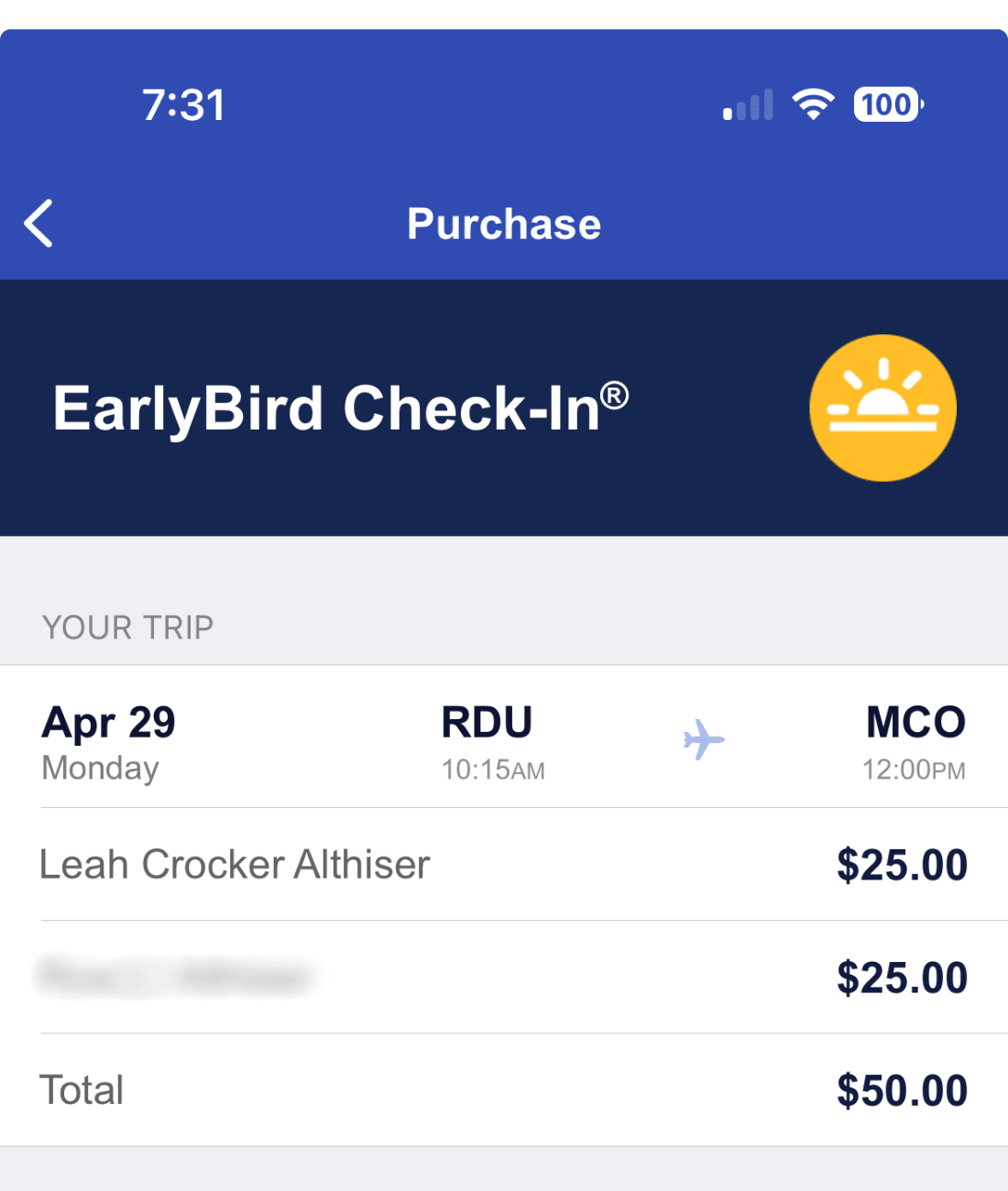

You’ll also receive two free Early Bird Check-ins per year, which is a valuable perk!

Early Bird Check-in means you don’t have to manually check-in for your flight.

You’ll be automatically checked in 24 hours in advance to get the best possible boarding position!

The charge for this service stars at $15 per person per flight, but for my recent flight to Orlando was $25 per person.

You have to pay for the Early Bird Check-in separately after you book your flight and use your Southwest Card to pay.

I did this and got a credit on my next statement that completely covered the $50 charge.

I keep this card in my wallet year after year because of these valueable perks that more than offset the annual fee.

How Do I Earn Point By Referring Friends?

The other main way I earn Southwest points for our travel to Disney World is by referring my friends (and readers here on the blog) to the Southwest card.

I genuinely love this card and the benefits it provides. I think you will, too, and you will want to share the card with your friends and family!

You can get a unique referral link for your Southwest card when you are logged into the Chase site, and start sharing your link.

If someone signs up for the card through your link, you’ll get points deposited into your account. This is a great way to earn points year after year just by sharing about a product that you love!

When Will I Get My Bonus Points?

Your points will be automatically deposited into your Rapid Rewards account a few days after the end of the billing cycle during which you met the spending requirement.

Then you are ready to start booking flights!

How Will Opening This Card Affect My Credit Score?

One common concern folks have about opening new credit cards is how it will affect their credit score.

I regularly open new cards to earn signup bonuses and my score has done nothing but rise over the years to over 800.

This is because when you open a new line of credit your overall credit limit increases (good for your credit score), which means if you ever carry any balance your debt-to-credit ratio goes down (also good for your credit score).

Opening a new card like this is particularly helpful if you plan to keep it for many years to come- which I recommend that you do to get your annual point bonus!

This will eventually increase the average age of your credit lines, also increasing your credit score.

Can I Get Both a Personal Card & a Business Card?

Yes! This is exactly how I earned my Companion Pass the first time (details below.)

If you run a small business or have a side hustle, you may be able to qualify for a small business card in addition to a personal Card.

If you do anything that makes money aside from your main job, then you likely can qualify for a small business card.

This includes:

- Selling things on Etsy or eBay

- Blogging or freelancing

- Driving for Uber or Lyft

- Hosting on Airbnb

Basically, anything that has the potential to turn a profit can allow you to qualify for a small business card. Your personal credit report will be pulled for the application and you personally are liable for spending on the card.

My preferred card is the card_name.

This card has an annual fee of annual_fees (not waived the first year) but also has incredible benefits, including:

- TSA Precheck Credit

- Annual anniversary points

- Four upgraded boardings per year

I feel like I am getting tremendous value from my small business card and keep it from year-to-year.

What is Southwest Companion Pass and how do I earn it?

My daughter flew with me for feree for years thanks to the Southwest Companion Pass

This question deserves a post unto itself, but I will try to be brief!

Anyone who earns 135,000 Southwest Rapid Reward points in a single calendar year automatically receives a Companion Pass from Southwest. This pass allows another person, designated by you, to fly with you for free for the remainder of that year and the following year.

Points earned from opening Southwest credit cards DO count towards earning a Companion Pass. So many folks (including myself) have opened both a personal and business Southwest card in one year and gotten most of the way to Companion Pass with these sign-on bonuses!

The best strategy for earning a Companion Pass is to time it so that you earn the points from the sign-on bonuses early in the year. I hit the point goal in February of this year, so I have had a Companion Pass for most of this year and all of next year!

One more thing – you are able to change your named companion up to three times during the time you hold the pass.

For example, I started out with my daughter as my companion. Then I switched my companion to my friend Toni so she could fly to Florida with me for free in September. Then I called and had it switched back to my daughter, who will remain my companion for the rest of the time I hold the pass.

What Else To Consider About the Southwest Credit Card

Here are some other points to consider about flying with points on Southwest:

- You can change or cancel your award flight at any point with no penalty (unlike other airlines which charge hefty change fees)

- There are three other cards you can add to your wallet and you can earn the sign-on bonus on each card

- The sign-on bonus from the cards counts towards earning a Companion Pass, which can stretch your miles even farther!

I hope this post showed you how I can fly to Disney World several times each year for practically free.

Click here to learn more about the Chase Southwest Plus Card.

I have helped several readers through the process of opening a Southwest credit card to earn points and I am happy to answer any questions you might have!

You can leave a comment on this post or contact me here.

Check out these related posts:

- Walt Disney World Swan Hotel: How To Stay For Free

- How To Earn Free Disney World Travel with Chase Sapphire Preferred

- How To Skip The Lines at Disney World

cc_advertiser_disclosure cc_editorial_disclosure

Comment Disclosure: Responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Meg

Friday 8th of December 2023

Having to spend $3k in a short period of time is not being "frugal", even if it does get you a few flights. Wait for sales and it'll be a while before that 3k was even hit. SW runs a sale twice a year, dropping flights to $39-$79 (and yes - it includes traveling across the country, I just did it) Let's be real, here. This is all about spreading your referral link.

Leah

Saturday 9th of December 2023

Hi Meg! I recommend using the card for things you are already paying for. I easily spend $1,000 per month on utilities, groceries, insurance and gas. Most families spending FAR more than that on these expenses per month making this an easy spending requirement to meet without any extra spending. These points don't get you a "few" free flights. I have booked many flights for 2,500 points per person, which means this bonus would get you up to 30 free flights. This post is about helping people learn how to be wise and earn free travel from their spending, which is absolutely part of a frugal lifestyle.

Lisa

Thursday 15th of June 2023

Hi Leah! I just booked a flight yesterday using SW to fly from Nashville to Orlando in Nov/Dec for my family of 5….paying $4289.80 for business select class. (We are in the middle of St Louis and Nashville and usually fly Nashville if going south because it’s cheaper. We never see flights as cheap as you do from Charlotte!). I then received your email today and double-checked my flights to see if I overpaid, but found by rebooking today with the 40off, I would actually pay about $1200 more! I have no idea how that happened because the fares seemed identical as yesterday.

I don’t have the SW Chase card, but instead the Chase Disney card:) We have built up quite a few points that we convert to a gift card and then pay a big chunk of our Disney resort cost and for food/items while there. They offer discounts for Disney Visa Cardholders on resort bookings from time to time as well. Side note on that card…my husband has Darth Vader’s face printed on his and gets so many comments from cashiers/waiters/etc who think it is so cool! Lol We also use the Cap One Venture with the annual fee and use our point balance to pay for the flights/other hotels. Looking forward to going to Disney World this Christmas! Thank you for all of your good info and tips!

Christina

Monday 7th of November 2022

I've never flown using points. On SW it shows the price/points for the to and from, but can you split bill? Like use your points for coming home and pay out for the flight there? It's actually cheaper to fly in and I can see paying to get there and using points to fly back. It's from Dallas so it's pretty pricey.

Leah

Tuesday 8th of November 2022

Hi Christina! Yes, you can definitely book one way on points and pay cash for the other. I do this often!

Joy Becker

Saturday 27th of July 2019

Thanks for explaining how you do it! I'm considering applying. Would love to fly to WDW for free!

Andrea

Tuesday 2nd of April 2019

Are you eligible to book using partial points/ partial payment. It's looking like we will need a little over 43,000 points to fly round trip (family of 3 from STL- which seems way higher, but now the normal according to their low fare calendar). I'm assuming I'll have about 41,000 points after the bonus & normal points per dollar spent at first. Wondering if they'll turn the remaining 2,000 points into a dollar amount- or if they will even let me book without the full amount of points needed. Any experience on this? TIA!!

Leah

Wednesday 3rd of April 2019

Ok, Andrea, I have a few ideas for you. First, you unfortunately cannot book with partial points on Southwest. But I think you can definitely get everyone there. Southwest runs fare sales often and some are better than others. The current fare sale isn't very good so be sure to sign up for SW's email alerts to get notified of new sales. This alone will likely get you into the 41,000 point territory. If not, it is easy to earn points through https://rapidrewardsshopping.southwest.com/ Recently I paid $19 for a one-month subscription to the Motley Fool for $19 and earned 5,400 points. So it is easy to get the extra points with offers here. Finally, if you find you are a bit short on points, just book the two roundtrips together and one leg of the third ticket, then pay cash for the return leg of the third ticket. The prices are the same on one-way and roundtrip so you won't be losing any benefit. Hope that helps!