Earlier this month some of you shared your financial goals with me in this post. I loved learning about what you hope to accomplish in the new year!

Here are some of your goals:

- Save for children’s college

- Pay down student loans

- Build emergency savings fund

- Work from home and have more time with friends and family

- Have money for travel

- Figure out to truly live within our means

I’m going to help you meet these goals with a simple plan of attack based on what I’ve learned over the years about achieving goals.

Please know I am right there with you trying hard to meet my financial goals for the new year, too. I’ll share my goals with you in a minute.

But first, here are the four steps I recommend taking to actually meet your goals this year:

1. Craft a measurable goal

2. Record your starting point

3. Develop habits that support your goal

4. Monitor your progress

I’ll walk you through the steps below with one of my goals as an example. Let’s go!

1) Craft a Measurable Goal

One key to meeting goals that many folks talk about is to make your goals measurable.

While a goal like “build an emergency fund” is great, it is not measurable since there is no amount attached. If you want to see real progress, make your goal something you can measure.

If you want to pay down debt, attach an attainable number to the goal. For example:

My goal is to pay off $4,000 of consumer debt by the end of next year.

This is one of my actual goals for next year. Based on what I expect to earn, I think this is a totally attainable goal.

2) Record Your Starting Point

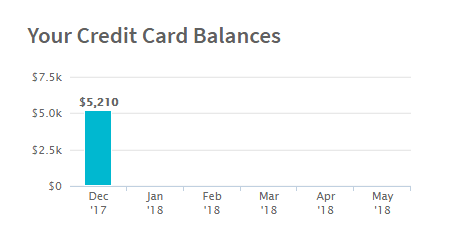

Since my goal is to pay down my consumer debt (i.e. credit card balances), first I have to know exactly how much debt I have. This can be hard to look at with honesty, but if you truly want to meet your goal you’ll do it.

I am using Credit Sesame to monitor my credit card balances. I highly recommend signing up for this free service – you don’t have to enter any account information and you can see all of your balances in one place.

Credit Sesame also shows you your credit score and gives you access to your credit report anytime. It is such a useful tool for meeting your financial goals!

Since I am starting with $5,200 in consumer debt and I’m going to pay off $4,000 this year, my goal is to end the year with $1,200 or less of debt. I can record this baseline (or starting point) in my planner or journal and then I’ll know what I’m working with.

So if your goal is to pay down your mortgage, or build up your savings, or make more money, find out and record your starting point somewhere you can reference it throughout the year.

3) Develop Habits That Support Your Goal

The most challenging part of meeting a goal is changing our ways. The best way to do this is to establish habits that support you in meeting your goal!

My favorite resource on habits is the book Better Than Before by Gretchen Rubin. She is one of my favorite authors and is an expert on habit change.

If listening is easier for you than reading a whole book, I also recommend her podcast Happier with Grethen Rubin.

In a recent episode of the podcast, she highlighted some habit strategies that can help you meet your goals in the new year. These include my personal favorites:

- Accountability: Share your goal with others to whom you feel accountable. We tend to do better when someone else is watching!

- Convenience: Make it easy to do the right thing and hard to stray from your goal.

- Loophole-Spotting: Look back at why you have failed in the past. What loopholes did you use to convince yourself you really didn’t need to meet your goal?

As an example, I’m creating accountability by sharing my goal with you all! Now it is out there in the world that I’m going to pay down this darn debt. Find a way to share your goal with others and encourage them to hold you accountable.

I’m using the strategy of convenience by automating my credit card payments. When $350 is automatically deducted from my checking account at the beginning of each month to pay down my debt, it becomes easier to meet my goal. Changing the reoccurring payment is a pain, so I’m more likely to meet the payment each month!

I’ve also spotted a loophole that has held me back from paying down debt in the past. I record all of my spending on groceries, gas, and household items each month with this simple envelope system.

But I conveniently didn’t have a way to record travel expenses anywhere! So I now have a spreadsheet set up to track those expenses, even if they are for my business.

So I encourage you to use these habit strategies (or others) to support you in meeting your financial goals next year.

4) Monitor Your Progress

I have found that if I closely monitor how I’m doing with meeting a goal, the more likely I am to meet it. When I ignore my goal (i.e. hide my head in the sand and pretend it isn’t there) and don’t it monitor closely there is about a 0% chance that I’ll actually meet it.

Since my goal is paying down $4,000 worth of debt, I am monitoring my progress every month with Credit Sesame and recording my balance in my monthly budget spreadsheet.

I encourage you to set up a system for monitoring your progress towards your goal. Put checkpoints in your planner at the beginning of the year if you need to.

If checking on your progress monthly isn’t frequent enough, then do it every week. Just find some way to actively monitor your progress and you’ll be encouraged when you see that you are moving towards meeting your goal!

While these four steps might seem obvious to some, putting them into action in your life is harder than it may seem. I encourage you to take some time in the next week or two to set yourself up for success in the new year!

If you want some encouragement or need someone to be accountable to, just leave a comment on this post or send me a message on The Frugal South’s Facebook page. We’ve got this!

Pamela Smith

Saturday 30th of December 2017

I am going to work on paying off my debt too. I can't make huge payments, but I am determined not to add any more on the card. I'm excited to watch the balance go down!

Leah

Saturday 30th of December 2017

Good for you, Pamela! It is so rewarding to watch that balance go down each month. Progress not perfection.