I have a secret weapon for saving money – one that makes my money disappear into a savings account before I ever have a chance to spend it!

The key is to automate your savings and I’ll show you how to do it in this post with a free online savings account.

How to Automate Your Savings

I use a free Capital One 360 savings account to automatically set money aside for various needs every month.

Here’s the key to actually getting that money saved: trick yourself by making it disappear into a savings account every month before you have the chance to spend it.

Before I had this savings method in place, I struggled to put money aside in a savings account. When I had a little extra money, I always found something I “needed” to spend it on.

If this also applies to you, you’re not alone – 69% of Americans have less than $1,000 in savings.

Clearly many people have trouble saving for an emergency fund or for short-term goals (like a car or vacation).

I have to make putting money into my savings account similar to a bill I have to pay every month. So I set up an automatic transfer from my main checking account to my online savings account in the amount I want to save each month to meet my goal.

That way I KNOW the money will be deducted and I can’t spend it on anything else – it’s now another bill that gets paid every month whether I like it or not!

How To Set Up Your Free Account

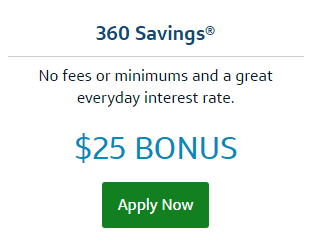

First, click any link on this page and opt to apply for a 360 Savings account .

If you already have an account with Capital One you can log in with that. If not, you’ll spend a few minutes entering your contact info.

Next, you’ll link a checking account from which you can add money.

You’ll earn a $25 bonus of FREE MONEY if you start with an initial deposit of $250 so definitely try to do that!

If you don’t have that yet you can always bookmark this page and come back later when you have $250 to set aside, or you can even open the account with no deposit (but you won’t be able to earn the bonus later).

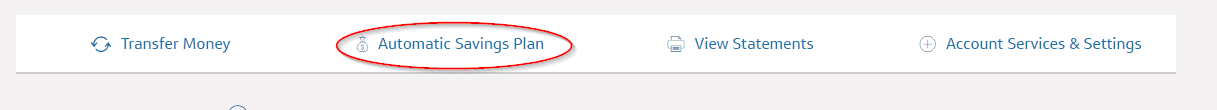

After you have your account set up and a checking account link, you’ll see the link to Automatic Savings Plan in the main menu. You can set up your deposit for as little and as often as you want – you’ll be amazed at how fast the money adds up!

Use Multiple Accounts To Meet Your Financial Goals

Maybe your goal with a Captial One 360 Savings account is to have $1,000 set aside in an emergency fund as Dave Ramsey suggests. Or maybe it is to set money aside for car maintenance so you won’t be hit by another repair bill and not be prepared.

I have $150 automatically directed to my car savings account each month so when the inevitable repairs are needed, I have money set aside.

If you want to separate your savings to keep track of different goals (like I do), then just open another savings account. You’ll only get the $25 bonus one time, but you can then save for different needs.

I have separate savings accounts for:

- Emergency fund – I actually keep this in a savings account in my main bank so I have it immediately on hand if needed

- Taxes – I’m self-employed so I am responsible for having money for taxes when the bill comes due

- Car repairs – recently had much more in it but I just spent $1,000 on a big repair – I’m so glad the money was there when I needed it!

- Disney vacation fund – currently with my sister’s money I’m keeping for her for their next trip!

You can easily move money back and forth from your Capital One 360 savings accounts and your main bank, though it might take a few business days for your transfers to show up.

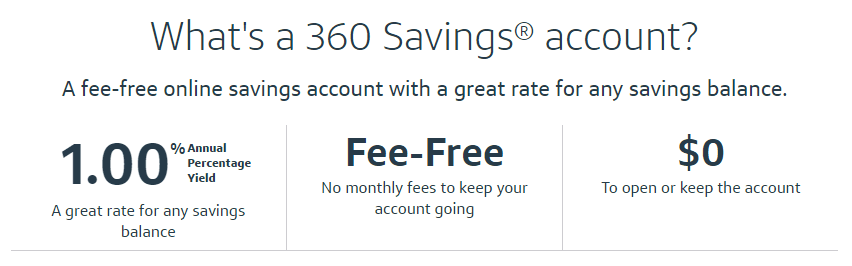

These savings accounts earn 1% APR, which is solid but not as high as other online savings accounts (such as Synchrony Bank which offers a 1.65% APR online savings account).

But here’s why I prefer Capital One 360 to the others:

- Can keep my accounts open even with $0 balance (Never have to worry about fees for dropping below a minimum)

- Can open as many subaccounts as I need to keep my savings separate (it takes one minute to open a new subaccount)

- Can automatically send money to different accounts and change that as often as I need

- Can do this all in their mobile app (other banks with high yield savings accounts don’t offer this)

I hope you’ll jump on the chance to earn an easy $25 bonus when you open a free Capital One 360 savings account.

If you are like me, you need your savings automated to make sure you are putting money aside. So jump on it and get the wheels in motion for meeting your savings goals – your future self will thank you for doing this now!

Any questions about this free online savings account or how to automate your savings? Please leave a comment below or send me a message on The Frugal South’s Facebook page!

Trevor Hall

Wednesday 11th of September 2019

I love your idea of opening different bank accounts for things that you regularly save up for. That way you can get more interest and have an easier time-saving. My wife and I are trying to save for retirement and I think that this would really help us reach our financial goals.

5 Easy Ways To Save Money in 2019 - The Frugal South

Sunday 13th of January 2019

[…] use a free online checking account from Capital One that allows me to set up automatic transfers from my m…. The money just disappears every month (like I am paying another bill) and stays out of sight until […]

40+ Resources for Living a Rich Life on a Budget - The Frugal South

Friday 28th of December 2018

[…] Capital One 360 Savings Account – I LOVE this free online savings account because you can automate your savings! Learn how I use an online savings account here. […]

Ep 18: Cheapskate Trip Planning Timeline + Steps - The Budget Mouse

Wednesday 29th of August 2018

[…] Online Savings Account + $25 Bonus To Get You Started […]