The number one way I stretch our travel budget is by leveraging points and miles I earn through credit card use.

Right now one of my favorite travel cards card_name is offering a great welcome bonus.

bonus_miles_full

These miles are easy to use to save hundreds of dollars on a Disney World vacation!

Read on to learn all about this excellent travel credit card or click here to go straight to the offer details (thanks for using my links and supporting my small business!)

How Do Capital One Rewards Miles Work?

What I like most about Capital One Rewards Miles is how easy they are to use.

In fact, they might be the easiest to use of all reward program miles.

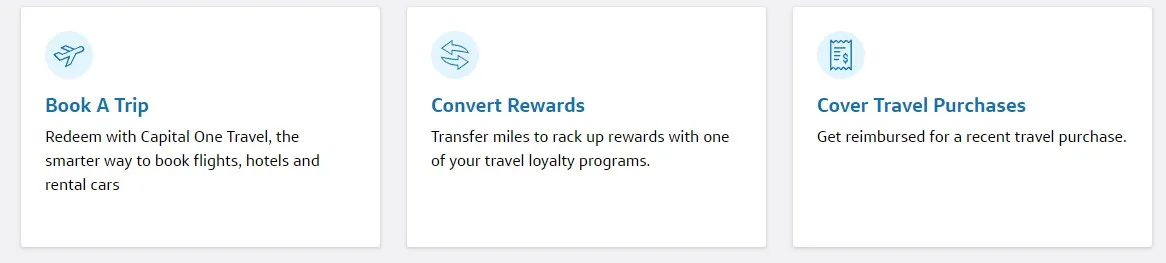

My preferred way to use miles is to “erase” travel purchases I make with the card.

I just use my Capital One card to purchase my hotel, flight, or park tickets, then I use miles to get reimbursed for the travel expense.

Learn how to use miles for travel statement credit next.

How Do I Earn Capital One Rewards Miles?

The easiest way to get lots of Capital One miles is to sign up for one of their credit cards.

My favorite card is the Capital One Venture Rewards Credit Card.

As I mentioned the thing I love most about this card is how easy the miles are to redeem for a travel statement credit.

But a close second is that this card earns 2 miles per dollar on every purchase every day.

For example, if you earn 75,000 miles after meeting the minimum spending requirement of $4,000 in the first three months after opening the card you’ll have at least 83,000 miles to redeem.

75,000 from bonus + 8,000 from minimum spending (4,000 x 2 miles per dollar) = 83,000 miles

If you redeem for a statement credit you’ll get $830 worth of travel costs erased from your balance.

That’s great value from one card bonus!

The Capital One Venture Card does have a annual_fees annual fee, but it comes with benefits that help offset that cost (read on for the details).

What Can I Use Rewards Miles For?

You can use miles for a statement credit for any purchase that codes as “travel” with Capital One.

You can book hotels and flights directly with Disney, or through a travel consolidator such as Priceline (click here to learn how to save up to 40% off already discounted rates for Disney World hotels).

It is hard to find miles you can use to book hotel rooms or packages directly with Disney, so this is a massive plus for Capital One miles.

But if you want to use your miles to buy Disney World park tickets be careful!

If you buy tickets directly from Disney they will NOT code as travel and you won’t be able to use your miles to erase the purchase.

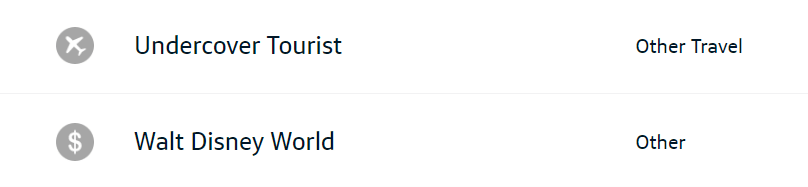

But if you buy discount tickets from my recommended ticket provider Undercover Tourist, the purchase WILL code as travel!

I confirmed this recently by buying one ticket from Disney and another from Undercover Tourist for my upcoming trip.

So if you want to use your travel statement credit to offset the price of theme park tickets, be sure to purchase from a site such as Undercover Tourist that will code as travel.

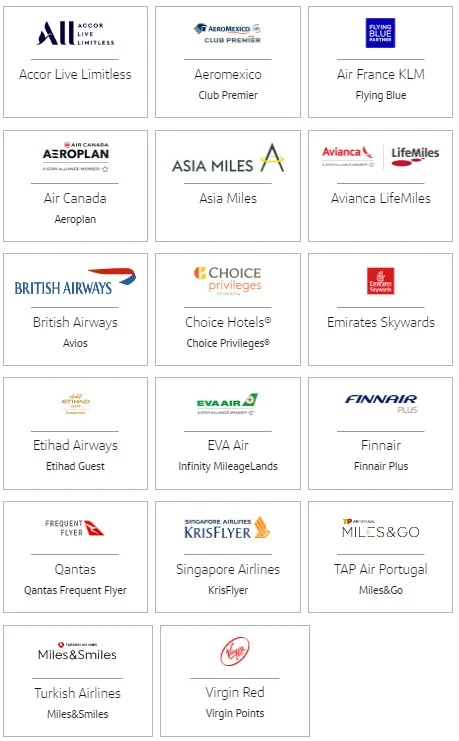

You can also use Rewards Miles to book a trip in the Capital One Travel portal or transfer your miles to 17 different loyalty programs.

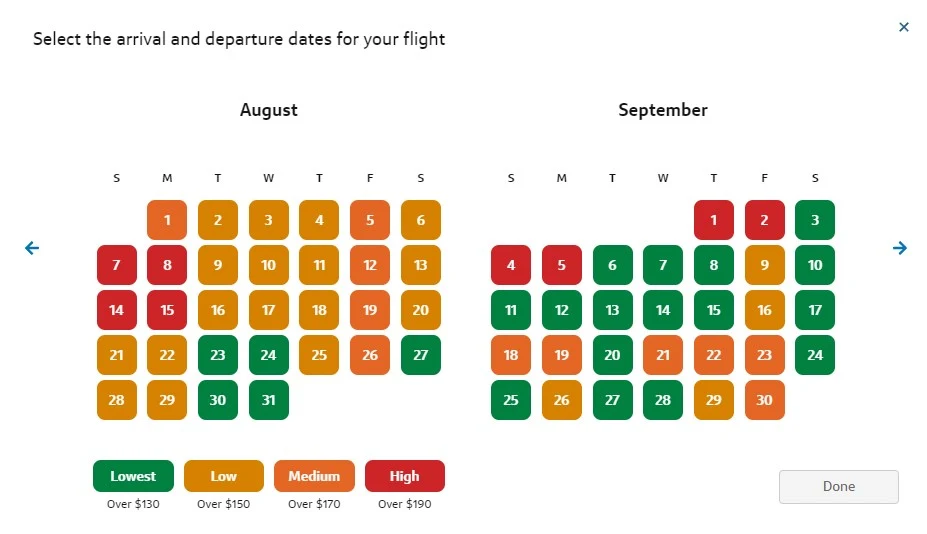

I find the Capital One travel portal very easy to use and have used miles to book trips there.

I particularly like their flight booking system because it shows you the cheapest dates to fly on a calendar. I am a visually-oriented person so this helps me a lot!

In my opinion, the transfer partners for Capital One are not as good as the Chase or American Express transfer partners.

The only hotel brand partner is Choice Privileges. Choice has great hotels in Europe, but not here in the US.

There are also no domestic airlines as transfer partners.

Unless you want to use your Capital One miles for a trip abroad, I suggest using them for statement credit instead of transferring them to a partner.

Capital One Venture Rewards Card Benefits

The Capital One Venture Rewards Card has an annual fee of annual_fees but I think the benefits that come with the card justify the fee.

First, you’ll get a $100 credit for Global Entry or TSA PreCheck when you use the card to pay the fee for these services.

I’ve had PreCheck since it began and I can’t imagine traveling without it! Children under 13 will get PreCheck status for free, so you only need it for the adults on your reservation.

Even if you only fly once each year, I think getting PreCheck is a good idea – especially if you have a card that essentially offers it for free.

Click here to learn how to apply for TSA PreCheck.

Complimentary Lounge Visits

Capital One has announced that this perk will end in 2025, so 2024 is your last chance to get this valuable perk!

With the Venture Card, you’ll get two complimentary visits per year to Plaza Premium Lounges or Capital One Lounges through the end of 2024.

Airport lounges offer free food and drinks (including alcohol) in addition to a separate space to relax and wait for your flight in an otherwise hectic airport.

These are the locations of the eligible lounges in the United States:

- Orlando International (Plaza Premium)

- Dallas-Fort Worth

- Denver International

- Washington Dulles

You’ll get access to the lounge up to three hours before your departing flight (not on arrival, however).

You CAN use your visit for a traveling companion and other guests are $45 each as a cardholder.

Capital One Offers

Another benefit of the Venture Card I use often is Capital One Offers.

You can add cashback offers to your card and get statement credit when you use your card for a purchase.

The other benefits of the Venture Reward Card include:

- No Foreign Transaction Fees

- Auto Rental Collision Damage Waiver

- Travel Accident Insurance

This is all in addition to earning 2% cash back on every purchase.

This is why I’ve had this card in my wallet for over five years. Earning 2% back makes this card excellent for everyday spending.

Click here to learn how to apply for the Capital One Venture Rewards Card (thanks for using my links and supporting my small business!)

I hope this post answered all of your questions about this card and using Capital One Rewards Miles for a vacation to Disney World or elsewhere.

Anything else you want to know? Just leave a comment below or email me at leah @ thefrugalsouth.com!