There is tremendous pressure in our culture to live beyond one’s means. Overspending on everything from phones to homes seems to be the norm.

Those of us dedicated to living within a budget and not succumbing to societal pressure to overspend definitely need some cheerleaders! So I’ve decided to share inspiring stories of folks who have found their own way to live well within their means. I hope this will become a regular series here at The Frugal South!

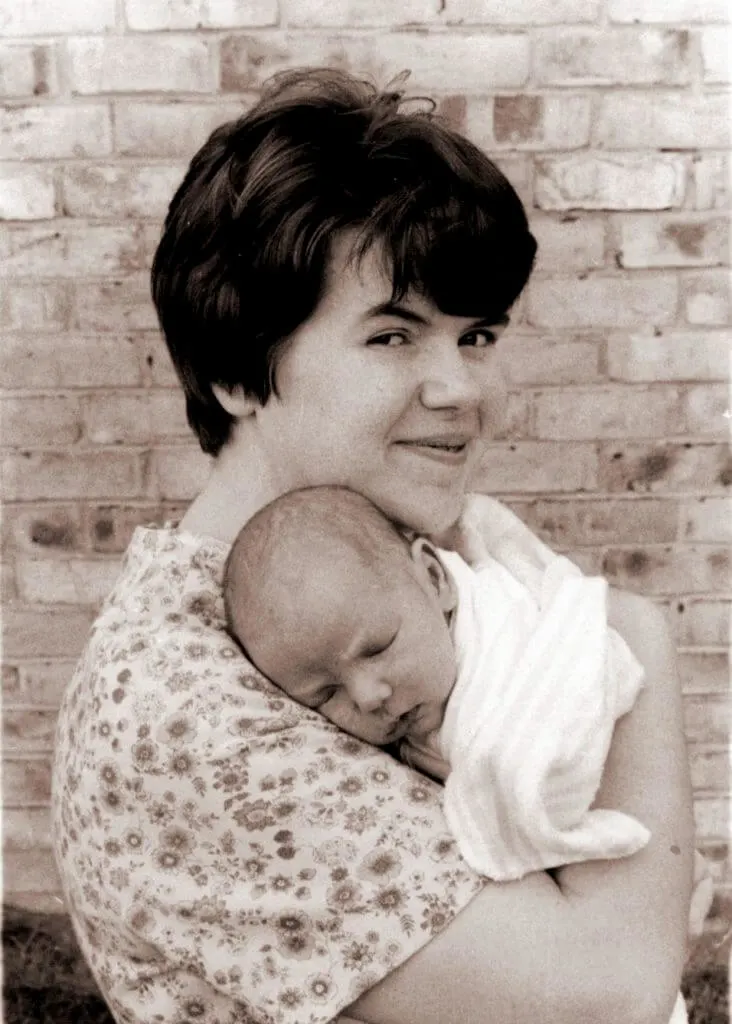

I’m starting out with an interview with a reader who has shared lots of helpful budgeting advice with me since I started the blog. She also happens to be my first cousin once removed. 🙂

Prue circa 1968

1. Please introduce yourself.

I am Prue, a now-retired librarian. I was a stay-at-home mom and school library volunteer until our two kids went to college and we needed a second income to pay tuition. My profession as a librarian grew out of that volunteer work; I went to grad school one course at a time at while the kids were undergrads. I live in north central Florida with my husband, John, a retired Air Force Officer.

Prue & John at their wedding in 1965

2. When did you first make a conscious effort to live within your means?

Basically, the minute we were married . We started out very poor, with nothing but a grant for grad school and a carload of wedding presents.

We were each very fortunate to have made it through our undergrad years without any student loans, due to a combination of scholarships, jobs, and family resources. In turn, our kids also made it out of college without debt – with a similar combination resources, including my job and making use of funds we received in modest inheritances that came from two generations back.

3. How do keep track of your budget?

We started a ledger book to account for every expenditure. After a few months, we created a “typical month,” based on how much we generally spent for various categories like rent, food, gas, etc. We set a limit on how much we could charge each month and kept a running total. When we got to the limit, we quit charging till the next month. It wasn’t as easy to get into credit card debt in 1965 since most credit cards were issued by individual companies that expected to be paid off monthly.

We borrowed an idea from John’s mother to create “pockets” within our account to help smooth out the occasional expenses like insurance premiums, car registration, etc. This involves adding up all the expected charges for a year, dividing by 12, and “paying” that level amount into the pocket each month.

Currently, we have four major pockets going – Utilities (which vary a lot with the seasons, but our pocket payments are level through the year), Medical (usual expenses not covered by insurance, such as biennial eyeglasses, dental cleanings, etc.), Insurance (car, long-term care, life insurance, car registrations, annual membership fees for organizations we belong to), and Adventure/Travel. It’s so nice to have the money already on hand when those bills come!

We still use this system, with modifications. Obviously, we are not accounting for every cent anymore, but we do still work on the typical month model. We sit together at the end of each month to plan the one coming up, checking in at mid-month to make adjustments if necessary. John set up a spreadsheet that has sections for all the monthly bills (where we plug in the charge amounts), a cash slush fund, and the pockets/categories. It does all the math automatically.

We charge a lot more things than we used to and, while we have a typical range that we usually fall into, we can have some major variations when we travel or make major purchases. We ALWAYS pay the whole balance each month. If we have extra left over after the bills and pocket payments are taken care of, it gets moved to savings; if we have spent a lot, we draw from savings so we end up with a fixed base amount in our account at the end.

We’ve also been very careful not to get in over our heads in house-buying, making sure the monthly payments were well within what we could afford on a regular basis. Our first house in California (which we bought with a no-down VA loan) and our second in Maryland did well for us when we sold them. In two years, our home in Florida will be paid off and we can use the money that has been going toward principal and interest to hire help in our “declining years.”

Prue and her husband of 50 years, John

4. Do you have a weakness? How do you handle it and still live within your means?

Retail therapy and sales. I try to focus on low-cost consumables when I go shopping for fun. A grocery store other than my usual one carries different brands that might be fun to try. I wait for sales on necessities as much as possible before buying. Reading sale ads in the Sunday paper is part of the adventure. I get an emotional boost from the savings.

5. How do you resist societal pressure to live beyond your means?

We’ve pretty much avoided societal pressure in many areas of life, not just financial. We’ve always been aware that we’re never going to be “cool,” so we’ve just charted our own path with things that work for us.

A family gathering

6. Any parting words of wisdom or tips?

Develop priorities. And work to develop them together as a couple. Obviously, these will change over time as family circumstances and interests change. I love to travel, so I’d prefer not to spend on things like full-price clothing, hair coloring (I “earned” my silver hair!), cosmetics, or mani-pedis (never had one of the latter) and save up for trips. We have also set a priority for church and charitable donations. Other people will have very different priorities and there is no need to judge each other’s choices – at least not out loud or on social media.

In the last ten years, we have received some substantial inheritances as our parents died. (They were very frugal!) While retaining funds for future “surprises” as we age and for charitable giving, we have distributed some significant chunks to our children and set up 529s for our grandchildren. I’m hoping that yet another generation can be student-debt free.

Thank you so much for the interview, Prue! You really are an inspiration. Please drop me a note here if you’d be willing to be part of this interview series!